The Upfronts are only a month away, and all eyes are on CTV. Upfront CTV ad spend is expected to reach $6 billion in 2022, up from $4.5 billion last year, according to eMarketer. And with viewers now spending more time watching ad-supported video-on-demand than ad-free subscription services, marketers have even more opportunities to reach this increasingly connected audience.

As CTV becomes a bigger part of the Upfront, Attention metrics can be especially helpful for marketers. Read below for some tips & tricks to demystify the CTV landscape from our new Upfront Planning Guide and sign up today for a free 1:1 planning workshop to help you maximize the impact of your Upfront. Marketers who sign up will receive a custom Upfront diagnostic and action plan, including a preview of their top five opportunities for attention.

Want to know how engaged viewers are on Hulu versus ABC? How do you make sure you’re not wasting ad dollars to reach the same audiences with the same inventory? Between the challenges of legacy ratings systems offering limited streaming metrics, and CTV platforms each using their own unique metrics, these can be difficult questions for media planners to answer.

Attention metrics can help.

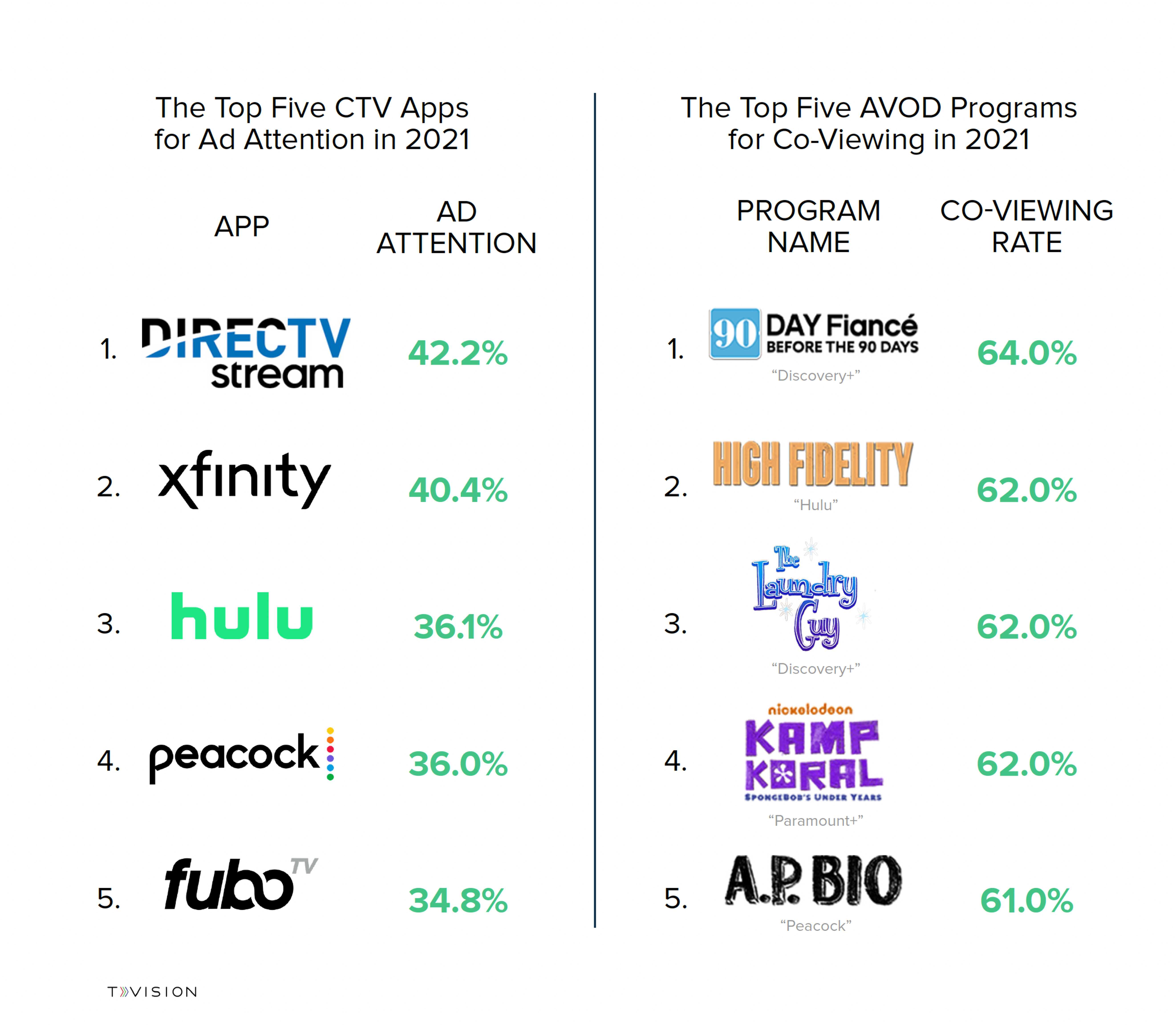

TVision’s CTV reporting makes it possible to make apples-to-apples comparisons across both Linear TV and CTV. maximize unduplicated reach, and gain much-needed transparency into CTV walled gardens. For those considering which CTV opportunities to prioritize during Upfront, here are the top apps for Ad Attention and top programs for Co-Viewing (more on that in the next section).

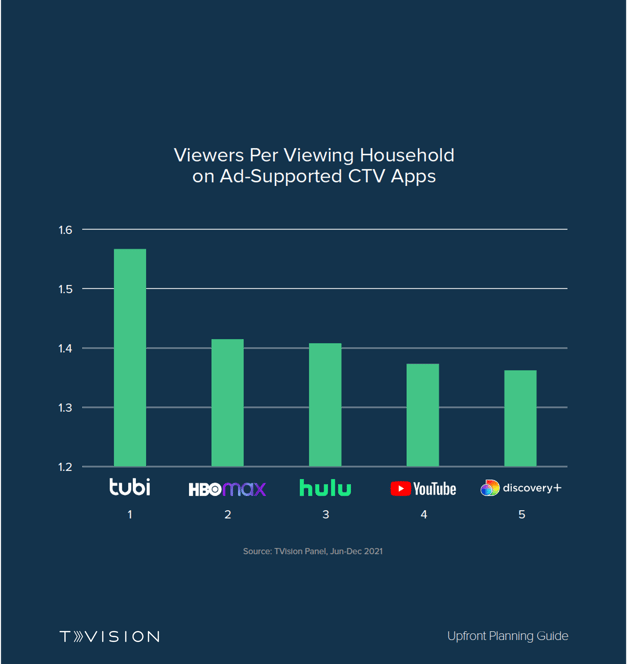

For effective Upfront media planning, marketers need to know definitively how many people are in the room, who they are, and who among them is paying attention. As we discussed in our previous blog, accurate Co-Viewing metrics are critical for understanding the real reach of CTV programming. Co-viewing rates provide a crucial distinction between household and person-level viewing and also serve as a multiple that can help both marketers and platforms better value their CTV ad inventory. Here were the top ad-supported CTV apps for VPVH in the second half of 2021.

For more insights on how to find CTV's true reach, check out our new CTV Co-Viewing Report.

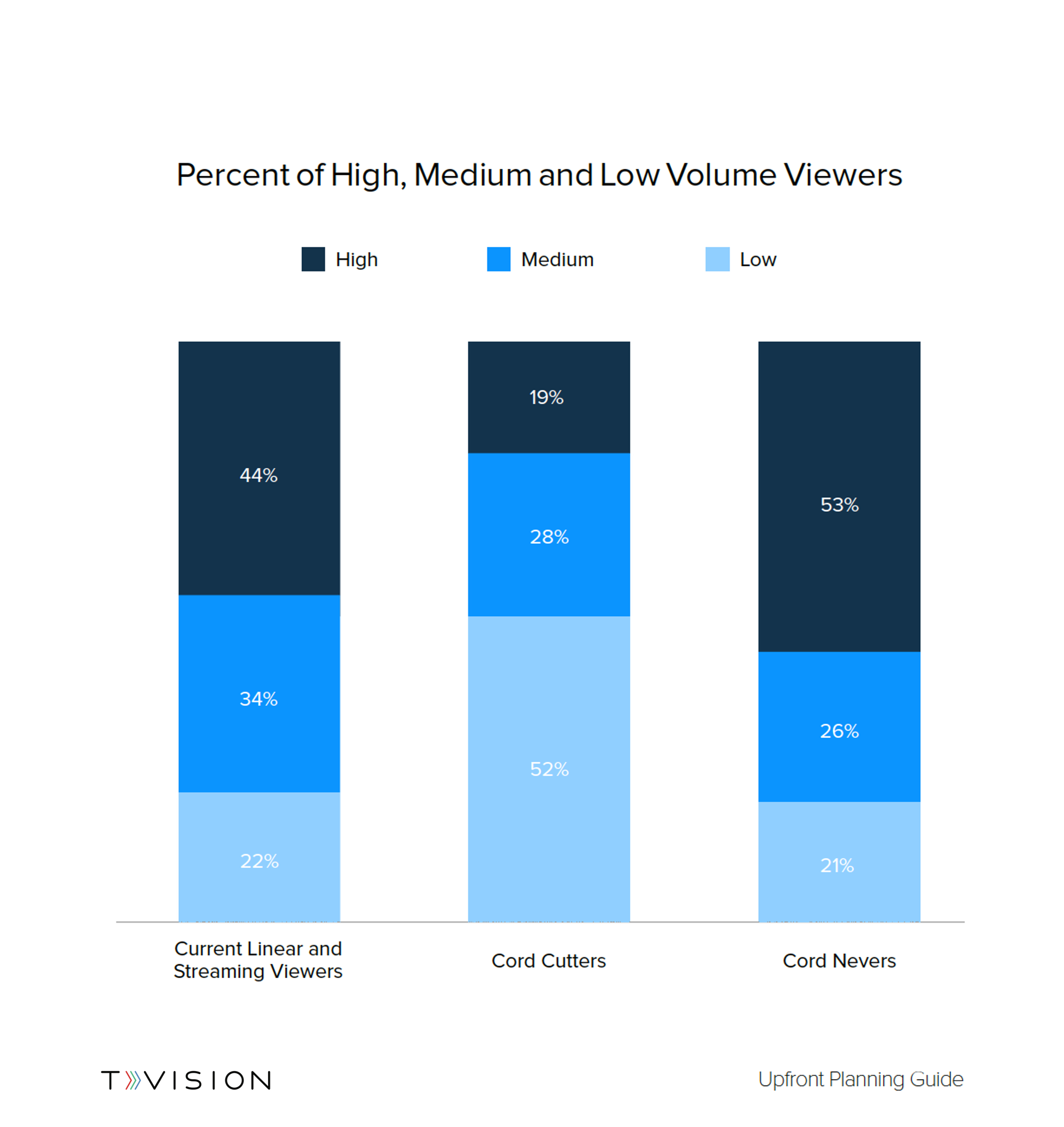

It’s a common myth that Gen Z exclusively watches CTV content, while older viewers only watch linear. The truth is most television viewers continue to consume both linear and streaming television. However, since many marketers are moving budget to CTV in hopes of finding audiences they simply can’t reach on linear television, TVision has begun tracking a group of viewers known as “cord nevers” - viewers who do not have a history of watching linear TV, and “cord cutters” - viewers who watched linear more than 6 months ago, but not since.

Cord nevers only make up 2% of all time spent watching television but tend to skew younger than the average TV viewer and watch fewer apps overall. 52% of cord-cutters are also low-volume TV viewers, which might explain why they spend significantly more time watching ad-supported apps vs. paid TV services.

As we mentioned above, CTV programming is being rapidly adopted by all demographic groups, not just the youngest generation. The data below helps illustrate the demographics of each group.

Cord Nevers: 48% of Cord Nevers are under age 34, with the vast majority under 18, meaning that a good portion of this younger generation does not engage with linear TV.

Cord Cutters: 49% of Cord Cutters are over age 55, which means that, contrary to widespread assumptions, senior viewers are also moving away from linear as streaming options continue to expand.

Cord Nevers are finding programming and content on fewer apps overall. These viewers tune into just 5.2 apps, compared to 12 apps for linear and streaming viewers.

The Upfront may be transforming, but attention data provides the transparency needed to navigate the changing landscape with confidence. Both marketers and media sellers can improve the Upfront process by better understanding the value of each impression. For more actionable insights, download the full Upfront Planning Guide, or check out our previous blog posts on getting ready for the Upfronts with Attention data and engaging live sports viewers.

TVision is offering free 1:1 planning workshops to help you maximize the impact of your Upfront. Marketers will receive a custom Upfront diagnostic and action plan, including a preview of their top five opportunities for attention. Sign up today to claim your spot.